In 2020, as the world shut down and was filled with uncertainty fueled by the COVID-19 pandemic, US-based entrepreneurs Boum III Jr and Anthony Miclet created Afrika Startup Lab as a way to provide support to African entrepreneurs through an unprecedented period of uncertainty. Two years of working with these African startups made Boum III Jr and Anthony Miclet very aware of the challenges facing African startups and entrepreneurs chief among these being a lack of access to capital and investors. Boum and Miclet soon realized it wasn’t a lack of investors interested in African companies but a lack of a middle ground bringing together investors of varying economic power and the right opportunities in one space. The desire to do exactly this gave birth to Daba: a social investing platform that allows people to learn about investing, invest in promising opportunities and manage their portfolios all in the same app while also bringing together investors ,entrepreneurs and investment opportunities from emerging countries in the same app.

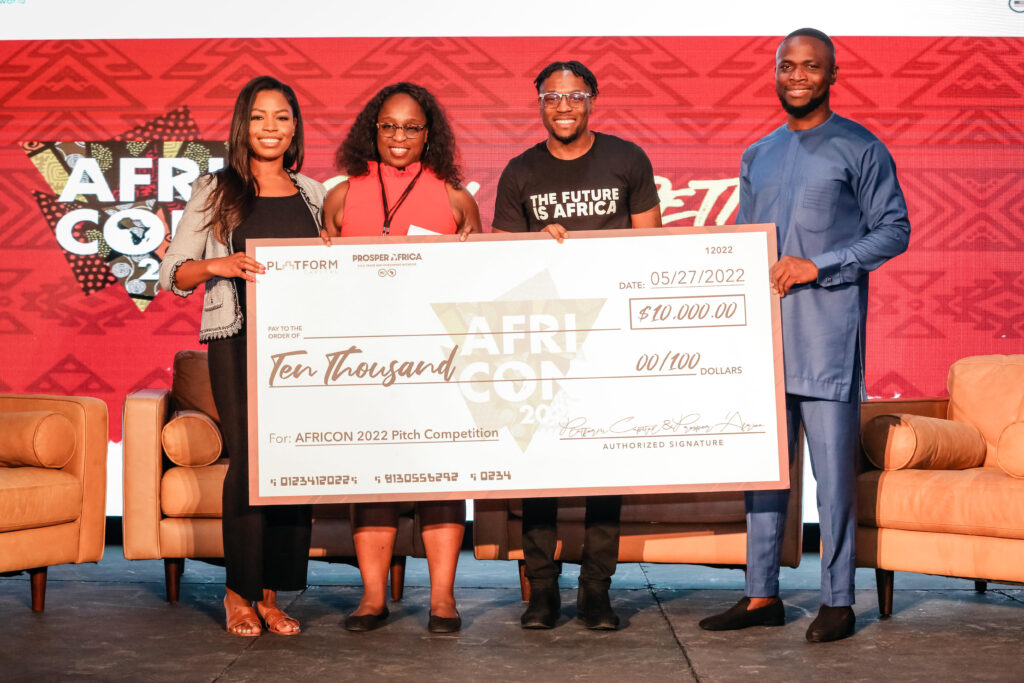

Today, the app is in public beta and recently won the AFRICON 2022 Pitch Competition at the just concluded AFRICON,

Here, we spoke with Boum III JR about what it is like winning the AFRICON 2022 Pitch Competition, the inspiration behind Daba, and what is next for the company trying to change how people invest in emerging markets.

What was the inspiration behind Daba?

My co-founder and I, at the height of the pandemic, decided to start a nonprofit called Afrika Startup Lab. It was just a group of friends that wanted to be useful in a time of uncertainty by supporting African entrepreneurs, offering them free advisory, and just being a sounding board in times of uncertainty. That effort scaled into a nonprofit supporting over 800 entrepreneurs across 15 African countries. And we have over 20 mentors that covered pretty much marketing, finance, engineering, sales, and every single function you can imagine. And my co-founder and I were active mentors in the community as well. I gave over maybe 200 hours of free advisory and mentorship in about a year. And those gave us a lot of lessons. The lesson was primarily that outside of the capacity building, training, advisory and all those things, African entrepreneurs needed capital. On the flip side, we were experiencing something very interesting, a lot of people were reaching out to us saying, ‘Hey, I know that at African Startup Lab, you guys are supporting entrepreneurs, if you see any investable companies, please do let us know.’ So that ticked off the light bulb in our head, ‘okay, there is an opportunity to intermediate investors willing to invest in Africa and investable companies that are looking for capital’. Our markets are under-invested, do not have enough participation and primarily because there is no intermediation between capital and opportunity. So that’s what inspired us to start Daba and, you know, we set ourselves to be that middle ground, that lets capital find opportunities deserving to receive it.

Right now, Daba is very African-focused, do you guys have any plans to branch outside the continent?

Our vision is to be the full-stack investment infrastructure for Africa and emerging markets. So the broader emerging markets are in our vision, but we do have to start somewhere. Africa itself is a vast land. I mean, it’s larger than, you know, the US and Europe. It’s a lot of ground to cover. But we believe that our technology is replicable outside of the continent and other emerging markets, for example, Southeast Asia. So yes, the plan is to be a global platform, but we’re very focused on Africa today. And that in itself already, so it’s a huge task and a huge undertaking.

So as someone who is not very investment savvy, when I was reading about one thing that kept coming up was ‘social investing.’ Could you tell me a little bit more about what that is?

So what we mean by social investing is merging traditional investing and social community and communication features. With our app, you can choose between a single-player mode and a multiplayer mode. A single-player mode is a traditional way of investing. That is you and your portfolio and you make your own decisions. And that’s it. The multiplayer mode brings in other ways of making investment decisions. And those other ways are twofold. One is through a managed portfolio approach, whereby we have embedded a managed smart advisory and portfolio management feature on our app. But the other way is the social community. So what we’ve built in the app is groups, and the ability to join investment groups, or pretty much communities on the application that are centered around a specific industry or specific topic where you can learn from the other members of the group, share and discuss ideas and pretty much form better opinions about industries through that communication. That communication already exists or happens on other channels, such as WhatsApp, Telegram, clubhouse, and Twitter spaces where people get together and talk about things like ‘hey, what do you think about FinTech in Africa? What do you think about agriculture? ‘ Those conversations happen, but they’re removed from where the investment action is taking place. So by taking a social investment approach, whereby we’re merging communities and investing, we’re enabling the conversation to happen exactly where the investment decision and action is being made. So that is what we mean by social investing. And there are other features around that other social features, such as you can share your investment portfolio with other people and they can just copy your investments and apply a similar strategy. So that’s why we call it a social investment app.

That’s fascinating. What do you think Daba will look like in five years?

In the next five years, I envision Daba being the premier destination for any investor, whether an individual or an institutional investor when they want to start or manage their investments on the African continent. I think in five years, we’d like to have a significant presence across the key markets in Africa like Kenya, Nigeria, Ghana, and South Africa, but also other emerging countries or economies within Africa, such as the Francophone region like Côte d’Ivoire, Senegal. So yeah, having considerable market share and presence in those markets, and very importantly, having grown the asset classes that we support on the platform, from not only venture capital to private debt, and probably real estate, and, and other publicly listed securities across the markets that I’ve mentioned. So that’s our five-year plan.

Daba won the Pitch Competition Africa 2022. Can you tell me what that felt like?

That was amazing. Number one, it was validation, that this is something that that specific audience relates to and a problem that they relate to and a solution that they want, you know, Africon is one of the largest gatherings of Africans in the diaspora, , willing to, participate in in shaping the narrative of the African continent. So being able to pitch and present Daba to that audience and them, selecting us from all the other amazing companies as the winner of the pitch competition for me, number one signaled and confirmed, validated that Daba is something that they resonate with and a solution that they want. that’s the first thing. And then the second thing is, it’s, it just felt great as well to be able to then collaborate with Amplify Africa to share the story of Daba. And, let people know why we exist, why we created Daba so that they can better understand our mission and our vision for the future of investing in Africa.

What impact do you think winning AFRICON Pitch Competition will have on Daba’s journey?

As a startup, resources are always limited. So I think the impact is twofold. Or maybe even three. First, the financial contribution helps extend our runway and helps us invest in our team, and continue building what we’re building. But beyond that, I think, being able to broadcast the story, not only with the people in the room but people that are going to learn about Daba through Amplify Africa’s social channels, allows us to share the story much further than we would be able to do on our own. So getting more people acquainted with Daba and aware of our mission. And the last piece is forming new partnerships. Partnerships that help us push the narrative forward like the partnership with Amplify Africa but also other organizations and groups that were present at the conference. So I think the impact that this has had for us is the financial input, which is always great but also being able to broadcast our story much further than we would have been able to do on our own and forming new relationships and partnerships with people that are synergistic to what we’re doing.

You can find the Daba app here: https://daba.page.link/SgVd Access: dabaEvryAfr